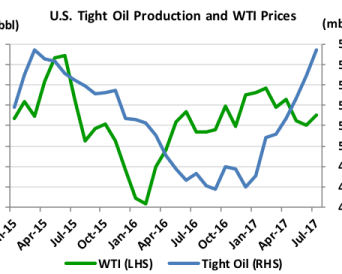

Global oil prices tumbled to six-month lows in June after an array of new supply data stoked pervasive doubts over OPEC’s strategy to reduce the massive stockpile weighing on markets. That the decision by OPEC and its nonmember partners to rein in production to hasten market rebalancing would lead to higher U.S. production was widely factored into forecasts, but the speed and scale of resurgent shale have raised alarms that a tidal wave of new supply is pushing prices toward the precipice once again.

Wary markets reached a breaking point last week after the major forecasting agencies released new data confirming production cuts implemented on January 1 by OPEC and non-OPEC partners have yet to make a dent in the massive surplus of oil inventories, while the sharp rise in prices immediately following the agreement has set in motion a surge in non-OPEC production. Futures prices for international benchmark Brent and U.S. West Texas Intermediate (WTI) are now trading around $10 per barrel (bbl) below their 2017 highs and in a much lower range of $45-$50/bbl in June.

Wary markets reached a breaking point last week after the major forecasting agencies released new data confirming production cuts implemented on January 1 by OPEC and non-OPEC partners have yet to make a dent in the massive surplus of oil inventories, while the sharp rise in prices immediately following the agreement has set in motion a surge in non-OPEC production. Futures prices for international benchmark Brent and U.S. West Texas Intermediate (WTI) are now trading around $10 per barrel (bbl) below their 2017 highs and in a much lower range of $45-$50/bbl in June.

The latest shift to a more bearish market sentiment contrasts with OPEC’s optimistic narrative that sees market rebalancing underway later this summer on seasonally stronger oil demand. New projections by the major forecasting agencies are in line with OPEC and its non-OPEC partners’ expectations of a slower rebalancing of markets, which was the key catalyst to extend the production cuts by a further nine months at their May 25 ministerial meeting in Vienna, but nonetheless markets were disappointed that the most recent data was so bearish.

The International Energy Agency (IEA) reported on June 14 that oil inventories in April, the most recent month available, were even higher than in the fourth quarter of 2016, when the producer alliance was hammering out its deal to cut production to hasten the drawdown of the record level of stocks. At the same time, the IEA unveiled its first forecast for 2018, which shows growth in non-OPEC production more than doubling in 2018 versus 2017. If true, supply would eclipse robust global oil demand growth next year, limiting any drawdowns in stock levels. Meanwhile, the OPEC Secretariat released its oil market report on June 13 showing OPEC production in May rose to the highest levels this year, largely due to increased output by Nigeria and Libya. Both countries were given exemptions from the agreement due to ongoing internal supply disruptions from civil unrest, but are now offsetting pledged cuts by other members. OPEC failed to adopt a mechanism to account for the eventual recovery of Nigerian and Libyan production, just one of a number of weak links in the agreement. Nonetheless, increased production from Libya and Nigeria was partially offset by lower supplies from the United Arab Emirates and Angola, with the Secretariat reporting the group’s production near compliance at 32.1 million barrels per day (mb/d).

The sobering data prompted a sell-off by traders weary of waiting for a decline in global oil stocks. Market analysts were already losing faith in OPEC and its partners after the May meeting, seeing the decision to extend the agreement to the end of the first quarter of 2018 as a weak response to stubbornly high stockpiles and arguing that the group should have implemented a much deeper cut to accelerate the rebalancing. Growing doubts over OPEC’s ability to reduce the massive stockpile prompted leading investment banks to lower their price forecasts for the first time in eight months, according to a survey by The Wall Street Journal. Further downward revisions are expected following the latest data from forecasting agencies. Futures prices for Brent crude were last trading around $47.25/bbl and WTI at $44.50/bbl. A sustained break above $50/bbl is not seen likely until data start showing both a substantial drawdown in global oil stocks and a significant slowdown in the growth of U.S. shale production. Equally, a decision by OPEC to deepen production cuts would also support higher prices.

The sobering data prompted a sell-off by traders weary of waiting for a decline in global oil stocks. Market analysts were already losing faith in OPEC and its partners after the May meeting, seeing the decision to extend the agreement to the end of the first quarter of 2018 as a weak response to stubbornly high stockpiles and arguing that the group should have implemented a much deeper cut to accelerate the rebalancing. Growing doubts over OPEC’s ability to reduce the massive stockpile prompted leading investment banks to lower their price forecasts for the first time in eight months, according to a survey by The Wall Street Journal. Further downward revisions are expected following the latest data from forecasting agencies. Futures prices for Brent crude were last trading around $47.25/bbl and WTI at $44.50/bbl. A sustained break above $50/bbl is not seen likely until data start showing both a substantial drawdown in global oil stocks and a significant slowdown in the growth of U.S. shale production. Equally, a decision by OPEC to deepen production cuts would also support higher prices.

Short-Term Market Strength

In its most recent report, the IEA data continues to show a strengthening of fundamentals in the second half of 2017, with demand outpacing supply by almost 1 mb/d in the third quarter and by an even stronger 1.3 mb/d in the fourth quarter. As a result, global stocks are now poised to decline by 1.2 mb/d in the second half of 2017 compared with a downward revision in the first six months of the year to a meager decline of 80,000 barrels per day (kb/d). The latest revision in forecast OECD oil stocks for the second quarter largely reflected an unexpected jump in April inventories, by a steep 620 kb/d.

However, stronger demand growth is forecast to far outpace supply increases in the second half of the year, now projected to post a sharp 2.2 mb/d increase over January to June levels, implying a drawdown in oil inventories of 1.0 mb/d in the third quarter and 1.3 mb/d in the fourth quarter of the year, assuming OPEC holds production close to its target at around 32.1 mb/d.

However, stronger demand growth is forecast to far outpace supply increases in the second half of the year, now projected to post a sharp 2.2 mb/d increase over January to June levels, implying a drawdown in oil inventories of 1.0 mb/d in the third quarter and 1.3 mb/d in the fourth quarter of the year, assuming OPEC holds production close to its target at around 32.1 mb/d.

Global oil demand is forecast to rise to 97.8 mb/d in 2017, up 1.3 mb/d over 2016, with non-OECD countries accounting for around 95 percent of the growth. Meanwhile, global oil supplies are projected to reach 97.2 mb/d on average this year, up by 300 kb/d compared with a decline of 350 kb/d in 2016. Assuming continued strong compliance for the remainder of the year, OPEC output is forecast to decline by around 500 kb/d to 32.1 mb/d while non-OPEC supplies are projected to rise by a steep 800 kb/d, with U.S. crude production accounting for just over 50 percent of the increase.

Dark Clouds Hanging over Market for 2018

In its first forecast for 2018, the IEA sees oil supply and demand fundamentals worsening compared to the more constructive outlook for the second half of 2017. After declining by a projected 600 kb/d on an annual basis, oil inventories are expected to flatline in 2018 as supply and demand remains roughly in balance.

Global oil demand is projected to rise by a robust 1.4 mb/d to a record 99.3 mb/d in 2018, breaking through the 100 mb/d threshold in the fourth quarter. Non-OECD economies, led by China and India, account for nearly the entire growth, according to the report. Meanwhile, investment banks, and consulting firms such as IHS Markit, among others, are forecasting higher demand growth of 1.5-1.6 mb/d in 2018. IEA projections are based on the International Monetary Fund’s April World Economic Outlook and assume that global economic growth – a key driver of global oil demand growth – will accelerate to 3.6 percent next year compared with 3.5 percent in 2017.

It is the projected surge in non-OPEC supply, however, that has triggered the latest bearish market sentiment. Total non-OPEC supply is now forecast to jump by 1.5 mb/d to 59.7 mb/d in 2018, with U.S. production set to account for two-thirds of the increase at 1 mb/d and new production from long-planned projects in Brazil, Canada, the United Kingdom, Kazakhstan, Ghana, and Congo accounting for the remainder, according to the IEA.

Shale’s Pyrrhic Victory?

But, as in previous years, shale oil, also called tight oil in the United States, continues to defy industry expectations with upward revisions to production forecasts a permanent feature of the market, with some estimates seeing a steeper increase of 2 mb/d in 2018. Forecasts are inherently flawed given the multitude of variables that can impact data points, and never more so than with the technology-driven fast-cycle production of shale. The major forecasting agencies, consulting firms, investment analysts, and even the U.S. independent producers working on the ground have chronically underestimated the potential of tight oil. The U.S. Energy Information Administration (EIA) has revised its 2017 annual forecast for oil production in the lower 48 states, which is a barometer for shale output, up by 1.2 mb/d over the past 12 months and its outlook for 2018 by around 650 kb/d already in the first six months of the year. The EIA is now forecasting tight oil production in the seven major plays hitting a record 5.48 mb/d in July.

But, as in previous years, shale oil, also called tight oil in the United States, continues to defy industry expectations with upward revisions to production forecasts a permanent feature of the market, with some estimates seeing a steeper increase of 2 mb/d in 2018. Forecasts are inherently flawed given the multitude of variables that can impact data points, and never more so than with the technology-driven fast-cycle production of shale. The major forecasting agencies, consulting firms, investment analysts, and even the U.S. independent producers working on the ground have chronically underestimated the potential of tight oil. The U.S. Energy Information Administration (EIA) has revised its 2017 annual forecast for oil production in the lower 48 states, which is a barometer for shale output, up by 1.2 mb/d over the past 12 months and its outlook for 2018 by around 650 kb/d already in the first six months of the year. The EIA is now forecasting tight oil production in the seven major plays hitting a record 5.48 mb/d in July.

Cost curve improvements have lowered the marginal price to $40-50/bbl range for the most profitable plays, though gains are at a smaller pace than in past years. New technologies, advancements in computer-generated data gathering, processing and analysis for precision drilling, and fracking are continually improving well productivity and development timelines. Total U.S. oil production is projected to rise by 820 kb/d production from the 2016 low point in September 2016 to July 2017, with tight oil accounting for about 85 percent of the growth at 690 kb/d, the latest EIA data show. The Permian Basin, the largest oil field in the United States, is forecast to increase by 430 kb/d over the same period, pushing output there to a record 2.5 mb/d in July.

As a key driver of future growth, it has become de rigueur for market analysts to closely track new drilling rigs and well productivity rates, especially in the prolific Permian plays. Well productivity in the Permian has posted staggering gains in just a few years, rising from just under 200 barrels per rig in January 2016 to a peak of around 700 barrels per rig by August. A marginal decline in well productivity since then, to about 625 barrels per rig in May, has led some analysts to question if a permanent decline has set in but a multitude of factors could reverse the recent trend within months.

As a key driver of future growth, it has become de rigueur for market analysts to closely track new drilling rigs and well productivity rates, especially in the prolific Permian plays. Well productivity in the Permian has posted staggering gains in just a few years, rising from just under 200 barrels per rig in January 2016 to a peak of around 700 barrels per rig by August. A marginal decline in well productivity since then, to about 625 barrels per rig in May, has led some analysts to question if a permanent decline has set in but a multitude of factors could reverse the recent trend within months.

The rapid rebound in shale is leading some analysts to question if innovative and ambitious U.S. oil producers will soon become victims of their own success. The unexpected rebound in tight oil production so far this year and estimates for even stronger growth of 800 kb/d to over 1 mb/d in 2018 are resonating with investors who lived through the price crash set in motion by unbridled growth in shale production of 3.9 mb/d from January 2010 to December 2014 and the ensuing rout of the shale industry that saw prices plumb to new lows. Now, with the rapid rise in shale oil production threatening to undermine OPEC efforts to rebalance markets and tip the market into another price crisis, eight major hedge funds have pulled over $400 million from the top 10 shale producers that have significant holdings in the Permian. Indeed, if WTI prices hold near current levels of $45/bbl the growth in shale production would slow considerably.

Saudi Arabia Ready to “Do Whatever It Takes”

For OPEC, the latest forecasts make it even more challenging to reach its goal of reducing oil stocks to the targeted five-year average range, OPEC’s benchmark for market stability. In hindsight, the group’s production cuts appear too small given stubbornly high global oil stocks, the relentless rise in non-OPEC production, especially from the United States, and now a recovery in Nigerian and Libyan output.

Saudi Arabia’s Minister of Energy, Industry, and Mineral Resources Khalid al-Falih notably said on May 8 that the alliance will “do whatever it takes” to rebalance markets and stabilize prices and he may now need to make good on that pledge. Falih said on June 10 at the 8th International Forum on Energy for Sustainable Development in Kazakhstan that he expects inventories will fall to the five-year historical average before the end of the year and, crucially, noted that Saudi Arabia may modify its policy if output cuts don’t have the desired effect. Falih clarified that “If we see over the number of weeks or months reasons to adjust, we will adjust.”

A decision to alter the agreement, including deepening cuts, could come in July when the Joint OPEC and non-OPEC Ministerial Monitoring Committee is scheduled to meet in Moscow. The JMMC continually monitors market developments and is empowered to recommend changes to the agreement as it deems appropriate. While the exact date for the Moscow meeting has not been fixed, it may take place after the next monthly market reports are released by OPEC and the IEA on July 12 and 13, respectively.