OPEC may need to maintain crude oil supplies at current lower levels for longer than planned, as surging U.S. shale oil dominates global oil markets for the next several years, according to a new report from the International Energy Agency (IEA). The historic OPEC and non-OPEC cooperation pact to lower production targets has provided a strong foundation for a reversal of fortunes in global oil markets since the end of 2016, with surplus global inventories sharply contracting and oil prices 25 percent higher than a year ago. However, as widely expected, the recovery in oil markets paved the way for sharp growth in U.S. shale oil production, the latest data from the IEA’s 2018 annual medium-term outlook show.

Beyond 2020, however, the call for OPEC crude oil supplies, especially from its Middle East members, will rise sharply to offset an expected slowdown in U.S. production growth and meet rising global consumption. The IEA expects a robust global economy will propel oil demand higher by almost 7 million barrels per day (mb/d), to 104.7 mb/d, by 2023. That is an average annual growth rate of about 1.2 mb/d over the 2018-23 forecast period. China and India remain the main engines of growth, and combined, account for 45 percent of the expected increase in demand over the period. The rapidly expanding petrochemical industry, especially in the United States and China, will be a key driver of record-setting oil demand.

Beyond 2020, however, the call for OPEC crude oil supplies, especially from its Middle East members, will rise sharply to offset an expected slowdown in U.S. production growth and meet rising global consumption. The IEA expects a robust global economy will propel oil demand higher by almost 7 million barrels per day (mb/d), to 104.7 mb/d, by 2023. That is an average annual growth rate of about 1.2 mb/d over the 2018-23 forecast period. China and India remain the main engines of growth, and combined, account for 45 percent of the expected increase in demand over the period. The rapidly expanding petrochemical industry, especially in the United States and China, will be a key driver of record-setting oil demand.

U.S. production, led by rising tight oil supplies, will cover 80 percent of the projected demand growth over the next three years, while higher supplies from non-OPEC Canada, Brazil, and Norway will meet the remainder. As a result, the call on OPEC crude is capped at current levels of around 32.3 mb/d in 2018 but falls by a steep 500 kb/d to just 31.8 mb/d for 2019, implying the OPEC and non-OPEC producer alliance will need to consider extending the existing production agreement or reducing supplies further post-2018 to avert another damaging rise in global inventories.

OPEC on the Ascendant

However, the IEA is forecasting a significant slowdown in U.S. production growth by 2021, due to a combination of cost inflation, gradual exhaustion of the most economically attractive drilling “sweet spots,” and escalating pressure by investors on companies to deliver much better financial returns. U.S. production is expected to increase by a massive 2.5 mb/d in 2018-19 but thereafter growth is forecast to slow significantly, easing to just 100,000 barrels per day (kb/d) in 2023. In turn, the call on OPEC crude supplies is forecast to rise from a low of 31.8 mb/d in 2019 to 34.1 mb/d by 2023, a substantial increase of 2.3 mb/d.

Shale Debate Dominates Global Outlook

The IEA’s forecast for a slowdown in the U.S. tight oil production growth is in line with a small but growing contingent of contrarian industry experts who are questioning the mainstream view that sees shale oil production as a perpetual fountain of growth. Indeed, the production outlook for U.S. shale has long challenged and divided the industry and, once again, was a major topic of discussion at the annual CERAWeek by IHS Markit March 5-9 in Houston. “I think there’s a new game. It’s no longer just about production growth. It’s also about return to shareholders, and I think the companies have heard them,” said Daniel Yergin, vice chairman of IHS Markit. “It’s a different metric than it was even a year ago.” CERAWeek, one of the most important gatherings in the industry, brings together OPEC officials, industry executives, independent shale oil producers, and bankers, among many others, from around the globe to exchange views on the outlook for the market. For the second year in a row, OPEC ministers and U.S. independent shale producers held a private dinner meeting to share their views of the market.

Echoing the IEA’s analysis of shale trends, a number of experts cautioned against overoptimism about potential growth during CERAWeek. U.S. drillers have focused their activities on the premium geological acreage, or sweet spots, which typically produce anywhere from four to six times the amount of oil than wells on the periphery of the play. “My theory is that you’ve got basically resource exhaustion that is beginning to take place,” Mark Papa, chairman and CEO of Centennial Resource Development and an early pioneer in shale development, told the gathering.

U.S. tight oil growth will be dominated by the Permian Basin, which sees production more than doubling, rising by 2.6 mb/d to 4.2 mb/d, by 2023, according to the IEA. Elsewhere, however, the steady improvement in drilling efficiency and well productivity has stalled or even decreased in some plays. Moreover, producers will increasingly be forced to move outside of the sweet spots to second or third tier drilling areas, requiring higher levels of investment just to sustain production. Continually developing new wells is critical since production falls sharply in the first year. The IEA forecasts U.S. light, tight oil expanding by 3.3 mb/d, to 7.8 mb/d, by 2023. The marked slowdown in production growth starting in 2019, in part, reflects the Brent futures price curve, which served as the basis for the IEA forecast. Under this scenario, prices ease toward 2020 and then reach $58 per barrel for Brent by 2023. The IEA cautions that production growth estimates could be revised higher if oil prices are sustained above these levels.

U.S. tight oil growth will be dominated by the Permian Basin, which sees production more than doubling, rising by 2.6 mb/d to 4.2 mb/d, by 2023, according to the IEA. Elsewhere, however, the steady improvement in drilling efficiency and well productivity has stalled or even decreased in some plays. Moreover, producers will increasingly be forced to move outside of the sweet spots to second or third tier drilling areas, requiring higher levels of investment just to sustain production. Continually developing new wells is critical since production falls sharply in the first year. The IEA forecasts U.S. light, tight oil expanding by 3.3 mb/d, to 7.8 mb/d, by 2023. The marked slowdown in production growth starting in 2019, in part, reflects the Brent futures price curve, which served as the basis for the IEA forecast. Under this scenario, prices ease toward 2020 and then reach $58 per barrel for Brent by 2023. The IEA cautions that production growth estimates could be revised higher if oil prices are sustained above these levels.

Financing Key to Tight Oil Production Growth

A multitude of variables is involved in projecting the trajectory of shale oil growth, not least of which is the willingness by investors to fund future production growth. “Technology and ‘sweet spots’ may be the keys to the shale oil revolution in the United States, but finance has been the fuel,” IHS Vice President Roger Diwan noted at the conference. The sustained recovery in oil prices and overall more balanced global oil market outlook have significantly improved the investment climate and renewed confidence by private equity firms and other investors to significantly raise the level of capital available to fund oil and gas projects. Increased access to financing, technology advances, cost discipline, and expanded use of digital technology will help drive strong growth through the next decade, according to a number of speakers at CERAWeek.

A multitude of variables is involved in projecting the trajectory of shale oil growth, not least of which is the willingness by investors to fund future production growth. “Technology and ‘sweet spots’ may be the keys to the shale oil revolution in the United States, but finance has been the fuel,” IHS Vice President Roger Diwan noted at the conference. The sustained recovery in oil prices and overall more balanced global oil market outlook have significantly improved the investment climate and renewed confidence by private equity firms and other investors to significantly raise the level of capital available to fund oil and gas projects. Increased access to financing, technology advances, cost discipline, and expanded use of digital technology will help drive strong growth through the next decade, according to a number of speakers at CERAWeek.

U.S. companies’ spending and operational strategies, however, have been under pressure from shareholders and investors to adopt more financial discipline. In response, U.S. independent drillers are increasingly focused on return on capital as opposed to production growth, which has tempered the outlook, the IEA notes. In contrast to more conventional oil projects developed by a relatively small group of companies, more than 250 U.S. independents operate in shale regions, with a large majority dependent on outside financing.

Feast Then Famine

The surge in shale production is expected to keep markets well-supplied near term but the IEA cautions planned capital spending in the global upstream sector could lead to a much tighter oil market early in the next decade. Each year the world needs to replace 3 mb/d of production lost from natural decline rates at mature fields, which is the equivalent of replacing one North Sea every year, according to the IEA.

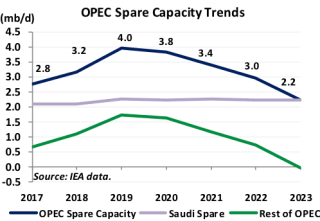

Global upstream capital expenditure in 2017 was largely unchanged from the previous year at $440 billion and only a modest increase is expected in 2018. Companies continue to focus on smaller short cycle projects such as shale plays or expansion of existing field production at the expense of new, larger scale conventional oil projects. Total non-OPEC oil supply is forecast to rise by 4 mb/d to 57.4 mb/d with U.S. tight oil accounting for 80 percent of the growth at 3.3 mb/d. Non-OPEC conventional crude production, which excludes shale, is forecast to rise by a meager 700 kb/d by 2023, according to IEA data. Without higher levels of investment, global spare production capacity could decline to a low 2.2 percent of demand by 2023, the lowest level since 2007, the IEA warns.

OPEC Production Capacity

OPEC will post only a relatively marginal increase in production capacity over the forecast period, as reduced spending or political turmoil undermine expansion plans. OPEC collectively is expected to add just 750 kb/d of new production capacity by 2023, to 36.3 mb/d. That is a downward revision of almost 60 percent from the 2017 forecast, which largely reflects Venezuela’s deteriorating economic crisis and a corresponding plummet in investment needed to maintain crude oil production capacity. Venezuelan production capacity is forecast to plunge by 650 kb/d, to just 1.1 mb/d, the lowest level since the 1940s. Angola is forecast to post the second largest decline as foreign oil companies shun the expensive deepwater projects.

OPEC’s Middle East members will raise capacity by a combined 1.6 mb/d over the period, with Iraq and the United Arab Emirates expected to post the largest increases. OPEC’s Middle East producers are investing heavily to increase production capacity as global oil demand accelerates. Saudi Arabia, which is the only country in the world that maintains significant spare production capacity, is already well-positioned to capture a higher market share when demand for the group’s supplies accelerates toward the end of the forecast period. Saudi Aramco invests billions of dollars to maintain production capacity levels of around 12-12.5 mb/d, with investments aimed at extending production plateaus and developing new fields to relieve pressure on mature fields. Saudi Arabia currently accounts for around 70 percent of OPEC’s spare capacity. Capacity is projected to average around 12.3 mb/d between 2018 and 2023, the IEA says.

OPEC’s Middle East members will raise capacity by a combined 1.6 mb/d over the period, with Iraq and the United Arab Emirates expected to post the largest increases. OPEC’s Middle East producers are investing heavily to increase production capacity as global oil demand accelerates. Saudi Arabia, which is the only country in the world that maintains significant spare production capacity, is already well-positioned to capture a higher market share when demand for the group’s supplies accelerates toward the end of the forecast period. Saudi Aramco invests billions of dollars to maintain production capacity levels of around 12-12.5 mb/d, with investments aimed at extending production plateaus and developing new fields to relieve pressure on mature fields. Saudi Arabia currently accounts for around 70 percent of OPEC’s spare capacity. Capacity is projected to average around 12.3 mb/d between 2018 and 2023, the IEA says.

Iraq has plans in place to raise capacity by almost 600 kb/d to 5.4 mb/d by 2023 but the IEA cautions there are “big uncertainties” on whether the beleaguered country can reach its targets. Significant security, financial, institutional, and operational hurdles may delay the project timelines. At the same time, the country’s foreign partners are seeking an improvement in contractual terms.

The UAE is on track to raise capacity to just over 3.5 mb/d, an increase of 360 kb/d. The Abu Dhabi National Oil Company has also been moving apace with plans to raise capacity following the award of new concessions for the onshore fields, and is in the final stage of concluding agreements for the offshore fields.

The IEA estimates Iranian production capacity will increase by just over 300 kb/d to 4.1 mb/d by 2023 but escalating tensions between Washington and Tehran and the prospect of an unraveling of the sanctions deal may continue to deter foreign investments and constrain growth.

The low-growth scenario for OPEC production is expected to lead to a gradual erosion of spare capacity, the IEA data show. Barring further increases in investment, production capacity is projected to decline to just 2.2 mb/d by 2023, with Saudi Arabia holding all surplus production. As the only holder of spare capacity, Saudi Arabia will continue to play a key role “in providing stability to global oil markets,” the IEA notes. While growth in U.S. tight oil is expected to dominate the market near term, the report emphasizes there will be “a continued reliance on OPEC countries for a major share of global supply.”

The low-growth scenario for OPEC production is expected to lead to a gradual erosion of spare capacity, the IEA data show. Barring further increases in investment, production capacity is projected to decline to just 2.2 mb/d by 2023, with Saudi Arabia holding all surplus production. As the only holder of spare capacity, Saudi Arabia will continue to play a key role “in providing stability to global oil markets,” the IEA notes. While growth in U.S. tight oil is expected to dominate the market near term, the report emphasizes there will be “a continued reliance on OPEC countries for a major share of global supply.”

Scenario Planning

The IEA’s outlook provides a broad scenario of evolving market fundamentals in the short and medium term but beyond the initial 12-18 month period, forecasts are inherently subject to change as events unfold, the macroeconomic view shifts, or new data emerge, among other reasons.

Near term, global oil supplies appear more than sufficient to meet projected demand, with OPEC expected to maintain its lower production targets early in the forecast. IEA Executive Director Fatih Birol warned during CERAWeek that OPEC producers will “need to reconsider their production plans quickly and substantially in light of the huge production increase from U.S. shale.”

OPEC, however, has already demonstrated a much more flexible and responsive approach to market developments, whether by announcing plans to further curb exports to oversaturated markets or implementation of deeper cuts than called for in the agreement to help hasten the market rebalancing. Indeed, the group’s more dynamic market management policy will put it in good stead to navigate yet another wave of shale oil production.